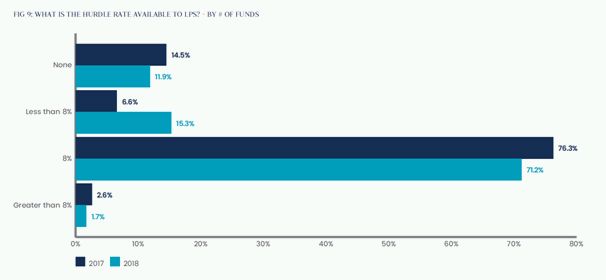

Hurdle Rate Private Equity

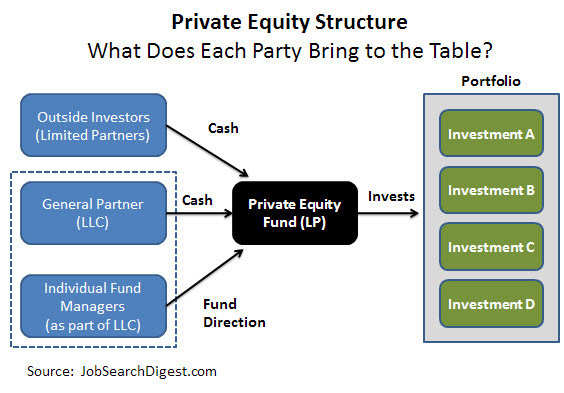

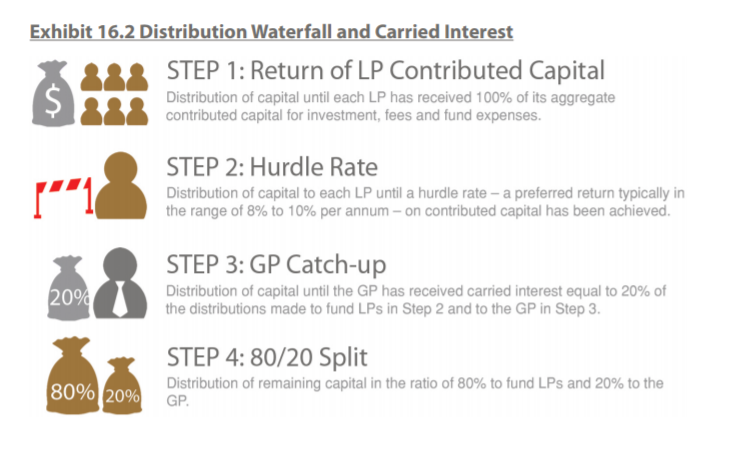

A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment. If a 1 million fund has a 10 hurdle rate which would be very high it must return 11 million after one year or 2 to 26 million after 10 years.

Alternative Investments Archives Page 4 Of 5 Prepnuggets

A hurdle rate is a yearly percentage return used to calculate the hurdle amount.

Chasing Waterfalls A Guide To The Distribution Of Financial Returns In Venture Capital And Private Equity Funds By Dr Mussaad M Al Razouki Medium

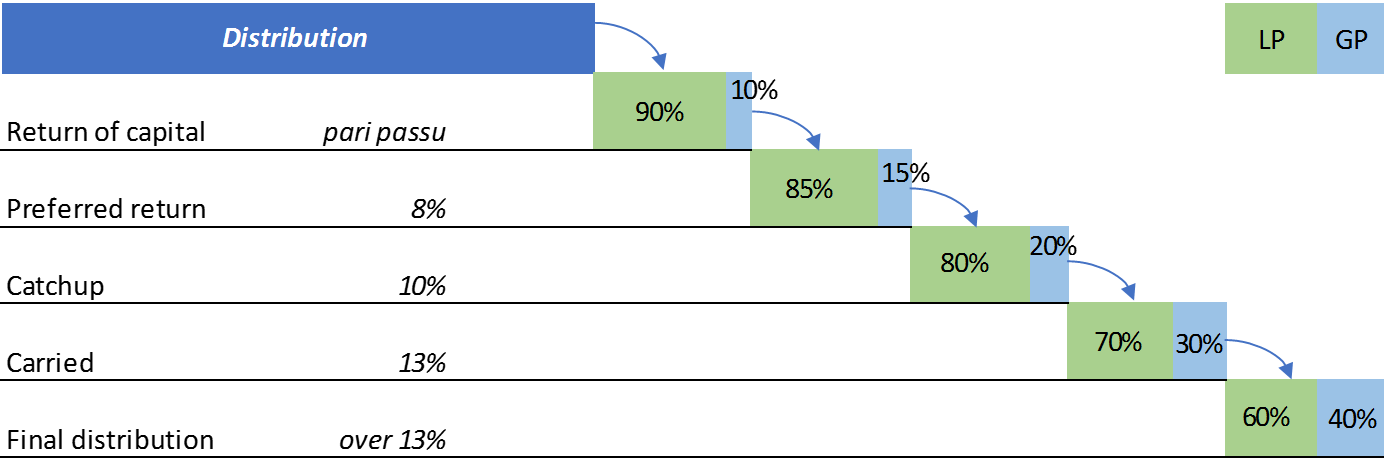

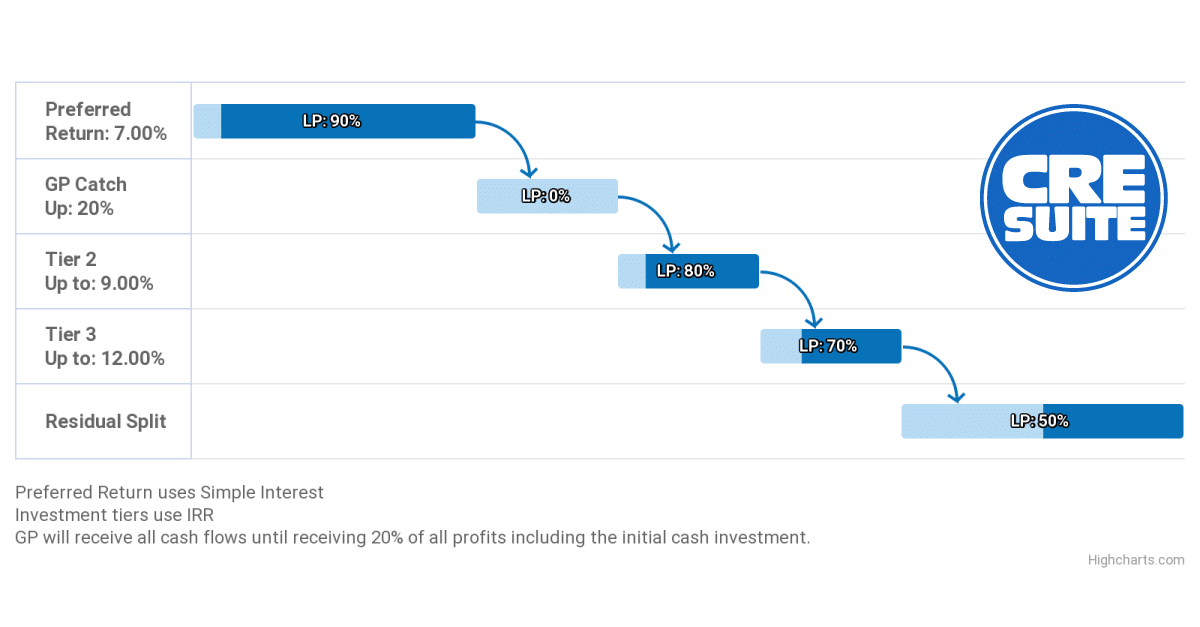

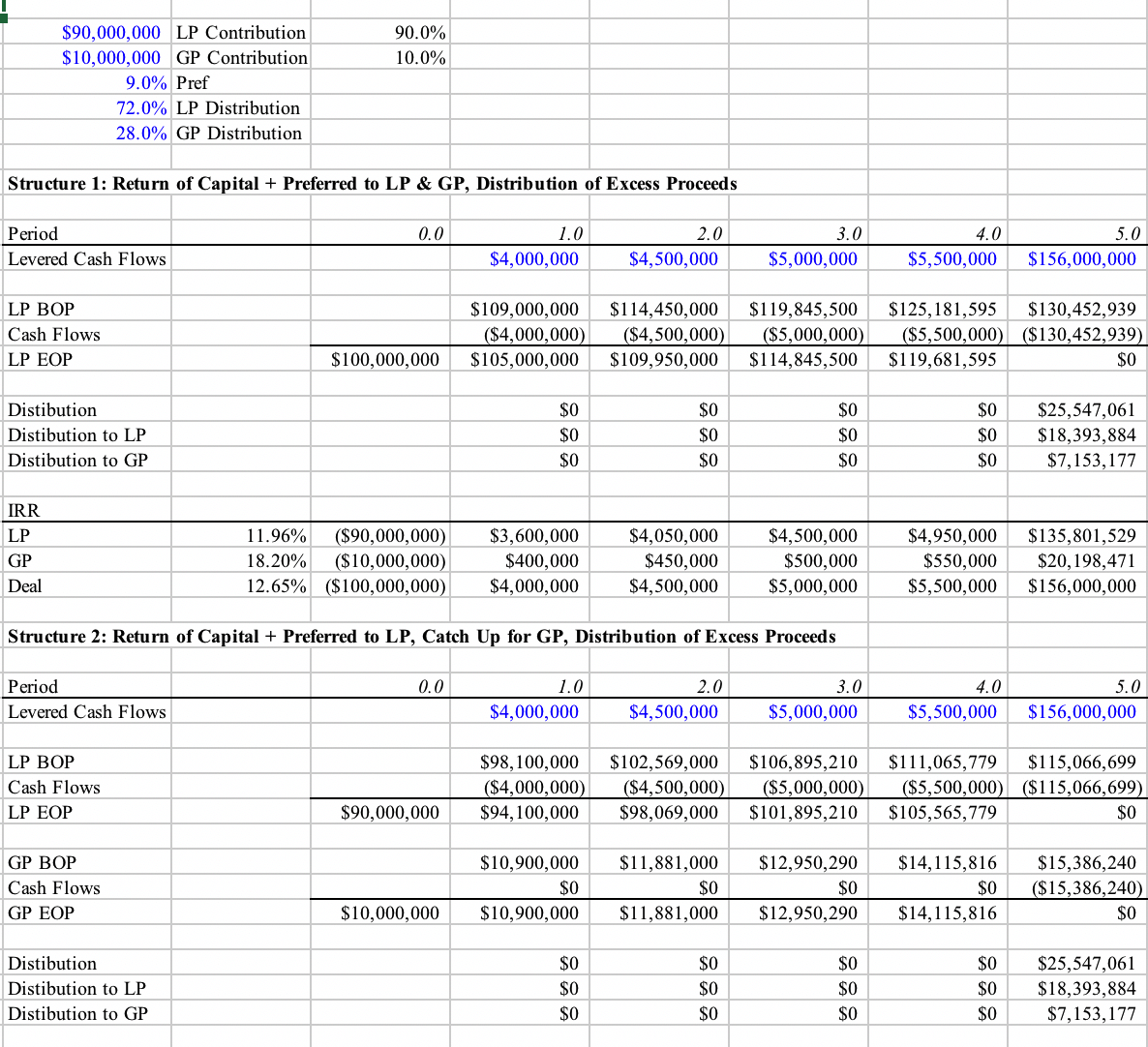

Distribution Waterfall Overview Importance Tiers

What Is A Private Equity Waterfall The Preferred Method Of Equity Funding

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Waterfalls And Hurdle Rates In Real Estate Private Equity Shenehon

Private Equity Fees And Waterfalls On Direct Deals Family Capital

Carried Interest Guide For Private Equity Professionals

Pe Waterfall Modelling Catch Up Wall Street Oasis

Private Equity Fund Terms Research Core Economic Terms Hurdle Rate And Carried Interest Corporate Commercial Law Uk

Private Equity Catch Up Calculation Asimplemodel Asimplemodel Com

Private Equity Fees And Waterfalls On Direct Deals Family Capital

Pe Waterfall Modelling Catch Up Wall Street Oasis

Pe Trust An Emerging Thai Alternative For Private Equity Funds Lexology